Road will be ready for new school

I have been assured that Newlands Drive in Hillside should be ready for the opening of the new primary school next month. Furthermore, the sign for School Brae which leads to the school should be going up shortly.

Newlands Drive is subject to a legal agreement between Aberdeenshire Council and Stewart Milne Homes to ensure it is substantially complete and fully open to serve new school prior to its opening. That said, Newlands Drive is unlikely to be formally adopted by the council until late 2018 or even early 2019.

The link between Newlands Drive and Barnhill Gardens is in an incomplete state and council officers are already pressing the developer to ensure that they remain aware of their responsibility to continue to maintain site to a suitable safe standard for public use. The state of the metal fencing and existing binder course surfacing has already been drawn to developers attention and this will continue to be monitored.

Welcome U-turn over business rates

In the meantime Aberdeenshire Council is asking for views on how best to structure a Business Rates Relief Scheme for Aberdeenshire: https://online.aberdeenshire.gov.uk/apps/news/release.aspx?newsid=4639

Who pays for council services?

This article from LGIU Scotland explains how councils are funded:

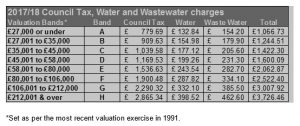

With a few exceptions, it looks like the majority of councils will increase Council Tax bills by 3%, the maximum rise they are allowed, and the first rises for nine years. At the same time, changes have been made to higher banded domestic properties meaning those residents will pay more in any case, as much as 22.5% for those in the highest banded properties.

Also, many businesses have seen their Non-Domestic rates bills increase considerably as a result of the 2015 revaluation of property values, the first since 2008, leading to warnings that many businesses will be forced to lay off staff or even close.

Understandably, all of this renewed interest in local taxation has led many to once again ask – who pays for local services, and what do they get in return?

It is often said that Council Tax only pays for a small proportion of the cost of local services such as Education, Social Care, Environmental services, and Libraries and Museums etc. While this is certainly true, it is also a bit more complex than that.

Council Tax funds around 14% of expenditure on local services; 17% is funded from Fees and Charges such as entrance fees to sports centres and parking charges; 17% is funded from Business Rates, although the rate poundage is set nationally; and 52% is funded from Central Government grant. These figures, of course, vary slightly from Council to Council. And, the 52% Central Government grant is itself raised from general taxation, with the main sources being Income Tax, Value Added Tax (VAT), National Insurance and Corporation Tax.

In other words, as an individual you may be paying for local services through Council Tax on the property you occupy, plus parking charges for the car you drive, a portion of Income Tax and National Insurance on your earnings, and a portion of the VAT on the goods and services you buy. In addition, if you own your own business you may be paying through Non-Domestic rates and Corporation Tax.

So, the answer is far from straightforward.

Leaving aside Fees and Charges which are for services you choose to use, how do you judge whether you are getting value for money from the taxes that you pay?

Again the answer is not straightforward. If you have no children, or your children are not at school, you may not place great value on Education services which account for around 33% of Council expenditure; or if members of your family are not in need of social care, you may not place great value on Social Work services which account for around 27% of Council expenditure; and as domestic refuse collection has moved from a weekly service to a fortnightly or three-weekly service, you may feel you are getting less of a service than previously.

But of course, these arguments ignore the fact that both Council Tax and Business Rates are local taxes, not charges for services, and are a way of funding services for the benefit of all, not just for the benefit of those who use the services. A fact not always understood by the public.

As mentioned previously, the Business Rate poundage is set nationally. In contrast, the level of Council Tax is set locally, collected locally and retained locally – so it is truly a local tax, albeit increases are restricted to 3%. However, even after twenty-five years of existence, the variation in the levels of Council Tax between Councils is not nearly as great as you might think, particularly between the four Cities and between neighbouring Councils. So, comparisons are not as valuable as you might think.

One of the consequences of a nine-year Council Tax freeze has been that it has stifled interest in Council budgets and Council services. So, in this regard, all the recent media coverage of Council Tax rises and Business Rates increases can be viewed as a boost for local democracy.

Looking ahead, will all of this heightened interest in local services prove to be a one off? I don’t think so. Even though a 3% rise is likely to become the norm over the next few years, the ever increasing pressure on Council budgets is likely to ensure a continued interest in local services, albeit the focus will be more on service redesign and service cuts.

More speed cameras on the A90

This strikes me as being a step too far – according to media reports the average speed cameras are to cover the Charleston to Stonehaven stretch of the A90.

However there is no work taking place on the A90 at Bridge of Muchalls, Newtonhill, Cammachmore or Portlethen. It is the right thing to do at Stonehaven and Charleston though.

The Courier reports that the 50 miles per hour cameras are due to be put in place this week by Aberdeen Roads Ltd, the contractor for the £745 million Aberdeen Western Peripheral Route/Balmedie-Tipperty scheme.

I have asked the AWPR managing agent to confirm (or not) whether there will be average speed cameras between Muchalls and Portlethen.

https://www.pressandjournal.co.uk/…/average-speed-cameras-…/

Spotlight on the rural area

The Aberdeen bypass, planning and noticeboards were among the issues discussed tonight by North Kincardine Rural Community Council. Ten members of the public watched – and participated – in the discussions.

The AWPR was as ever a major cause of concern especially regarding the impact on local roads: potholes and damaged verges. Residents were urges to report all potholes as any future claims for damage will be valid only if that is so.

The meeting was assured that Aberdeenshire Council will be expecting the road construction joint venture companies to contribute to the costs of returning the roads to a reasonable standard. Reference was also made to an extension to the 50mph average speed cameras to cover Charleston to Stonehaven.

The North Deeside Road junction with the B979 at Milltimber Bridge was condemned as being bewildering for drivers.

It will be 10 years on 16 April since Lairhillock primary school opened.

The community council committed to keep noticeboards at Corbie Hall, Banchory Devenick School and Lairhillock School. Noticeboards would be shared at other sites, such as Cookney Hall and St Ternan’s Church. Existing noticeboards will be removed as they fall into disrepair.

No objections to new planning applications are to be lodged.

An update was given on progress with installing broadband across the area.

There was a warning of thieves siphoning diesel from tanks at unoccupied houses.

New library service for Muchalls

Warning of speed limit on B979

Options to pay council tax

During the Facebook discussions about the looming increases in council tax, there was a query about whether there is an option to pay over 12 months rather than the standard 10 months. I followed this up with Aberdeenshire Council’s revenues manager Gail Smith. Here is what she has to say:

“The standard repayment period as per legislation remains at 10 months but we will offer different repayment plans including 12 months dependent on the circumstances of the customer.

“If a customer is having difficulty in paying over the 10 months they need to contact the council tax team to discuss other options and we will ensure a suitable repayment plan will be agreed on based on the customers current financial position.

“This does not mean these payment terms will continue indefinitely for future years and would be reviewed on an annual basis or when the customer advises their circumstances have changed.”

That confirms what I thought – and what I posted on Facebook at the time. So, if you are in a bit of financial difficulty the council will do what it can to help. But otherwise it is 10 payments (or one annual payment) for everyone.

Transformation for two Co-ops

Well, I’m sorry that the Co-op is selling two of its stores in Portlethen to McColl’s. When they gave up the shop in Newtonhill, it went downhill rapidly. Hopefully McColl’s will maintain the standard set by the Co-op.

I was in the shop at the Green this afternoon and there are notices up saying it closes on Saturday 18 February and will reopen under the new owners on Tuesday 21 February. One of the notices says they would like “to thank you for your custom.” It’s been a pleasure.

I understand that the Co-op at Rowanbank Road will also close on 20 May, to re-open as a McColl’s. That will leave the Hillside branch as the sole Co-op in town.

The post office branch will remain in the Rowanbank Road store.