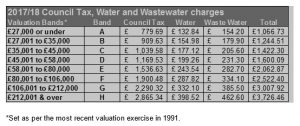

The final figures for what we will pay in council tax and water charges have now been released by Aberdeenshire Council. These figures take into account the Scottish Government-imposed increase for homes in band E and above (affecting 57.59% of homes in the North Kincardine ward), as well as the 2.5% increase put forward by the council’s SNP/Labour administration.

The national increase and the local increase combined will increase the total council tax income for Aberdeenshire to £133 million.

There is help available for those on a low income under a council tax reduction scheme, which replaced council tax benefit in 2013.

Anyone who is liable to pay council tax can apply for council tax reduction, which is a means tested scheme calculated on the basis of a household’s make-up and income.

The scheme includes a reduction specifically intended for people living in a band E-H house. People already in receipt of council tax reduction and living in band E to H properties do not need to submit a second claim.

To qualify for this new reduction you must meet one of the criteria listed below:

• Single claimants must have an income of less than £321 per week (£16, 692 per year).

• Couples and claimants with dependent children must have an income of less than £479 per week (£24,908 per year).

In order to qualify for the reduction you need to submit a valid claim along with the required supporting evidence. You can apply on-line at http://www.aberdeenshire.gov.uk/benefits-and-grants/welfare-reform/council-tax-reduction/

If you are liable for council tax from 1 April 2017 and think you might qualify it is important that you submit a claim for council tax reduction by 30 April 2017 as backdating is limited to one month for working age claimants and three months for those of pension credit age.

If you have any queries on the above scheme you can email asat@aberdeenshire.gov.uk or phone 03456 608 1200.

To find out which band your house is in click on this link: https://www.saa.gov.uk/